LICENCIAS

CERTIFICADOS

EXECUTIVE EDUCATION

Asesoría financiera integral.

Todas las soluciones y servicios en un solo lugar.

Portafolios y Cuentas de Inversión.

No se requieren montos millonarios para acceder a nuestros productos y servicios.

Soluciones de Seguros.

Escogemos las soluciones de seguros que mejor se adaptan a su plan financiero.

CUATRO RAZONES

1

Comprometidos con su visión de inversión

2

Su cuenta en una institución con respaldo y prestigio

3

Rendimientos Consistentes

4

Enfocados en la protección del capital

![]() Infórmese con Grove

Infórmese con Grove

Conozca noticias y actualidad del sector financiero

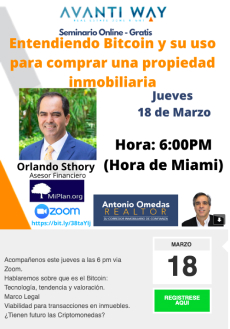

Marzo 18, 2021.

Webinar en Youtube

Tendencia de Los mercados Abril 28

Evolución de los mercados

Grove Wealth Management es el resultado de 25 años de una comprobada y exitosa trayectoria de profesionales que han transitado los mercados financieros Latinoamericanos, Estadounidenses y Europeos.

Nace en 2016 como la solución de establecer un vehículo de inversión seguro dentro de la regulación norteamericana, para poder ofrecer nuestros servicios de consultoría y manejo de inversiones a clientes latinoamericanos e hispanos en Estados Unidos.

¿Quiére mÁs información de nuestros servicios?

Déjenos sus datos y nos comunicaremos con usted

Portal para clientes

Portal para clientes CONTACTO

CONTACTO